AARP® Medicare Advantage from UnitedHealthcare

AARP United Healthcare is a partnership between AARP (formerly known as the American Association of Retired Persons) and United Healthcare, one of the largest health insurance providers in the United States. AARP is a nonprofit organization that advocates for the well-being and rights of individuals aged 50 and older.

AARP United Healthcare offers health insurance plans specifically designed for AARP members. These plans provide coverage for various healthcare services, including hospital stays, doctor visits, prescription medications, preventive care, and more. The partnership aims to provide affordable and comprehensive health insurance options to meet the needs of older adults.

AARP United Healthcare plans often come with additional benefits and resources tailored to the needs of older individuals, such as access to a network of healthcare providers, wellness programs, discounts on prescription drugs, and tools for managing healthcare costs. The specific details of the plans may vary depending on the location and specific plan chosen.

It's important to note that while AARP endorses United Healthcare as a provider of health insurance plans for its members, AARP itself is not an insurance provider. Instead, AARP collaborates with United Healthcare to offer health insurance options under the AARP United Healthcare brand.

Medicare Advantage plans from AARP/UnitedHealthcare are a good deal. There are many $0 plans available, and the average cost of $21 per month is lower than other companies like Humana and Blue Cross Blue Shield.

AARP/UnitedHealthcare plans have a good overall rating of 4.2 stars. But the downside is its user rating of 3.6 stars, indicating issues with customer service and ease of use.

Good for

Bad for

Our Thoughts: Why We Recommend AARP/UnitedHealthcare Medicare Advantage

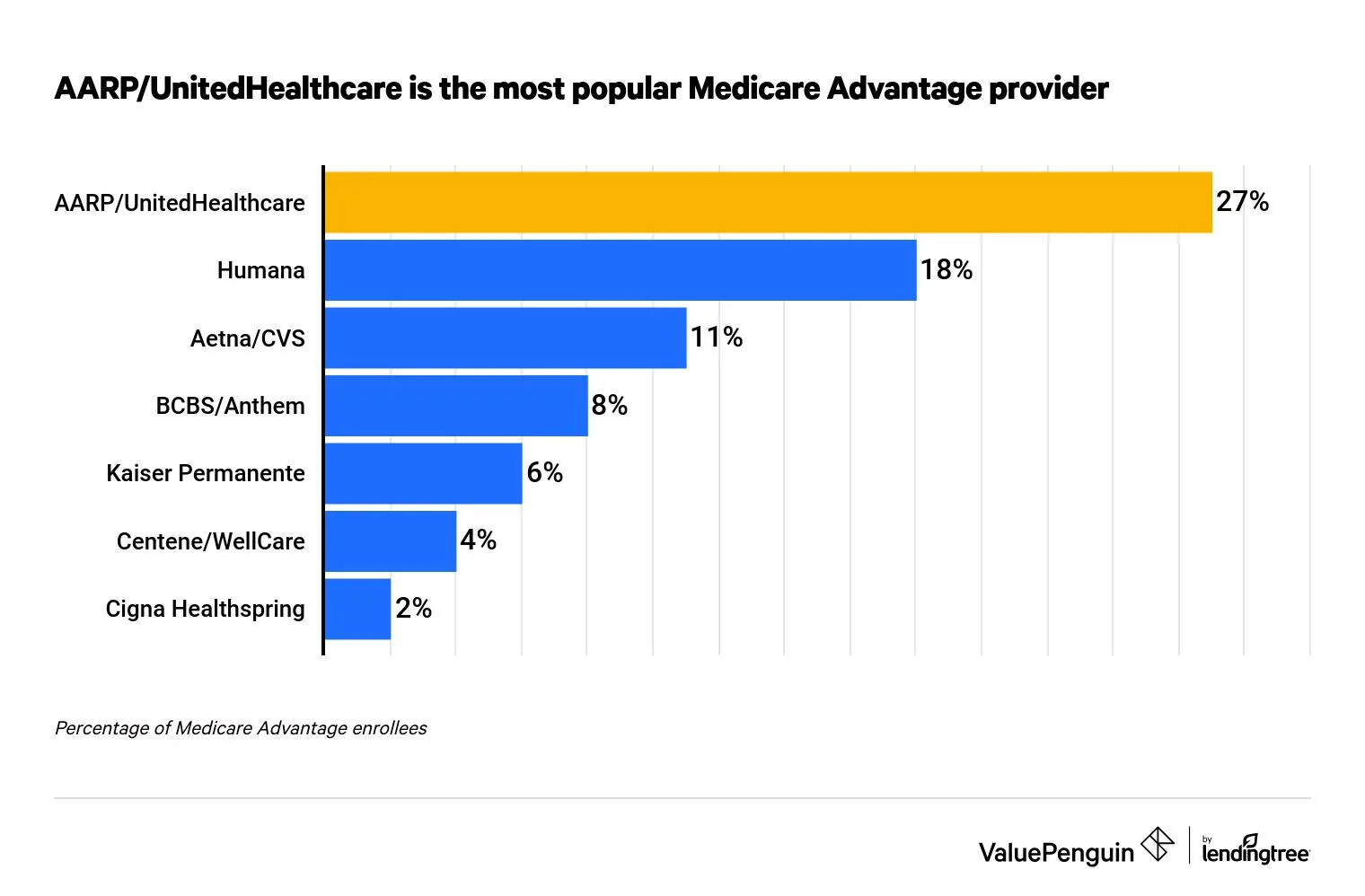

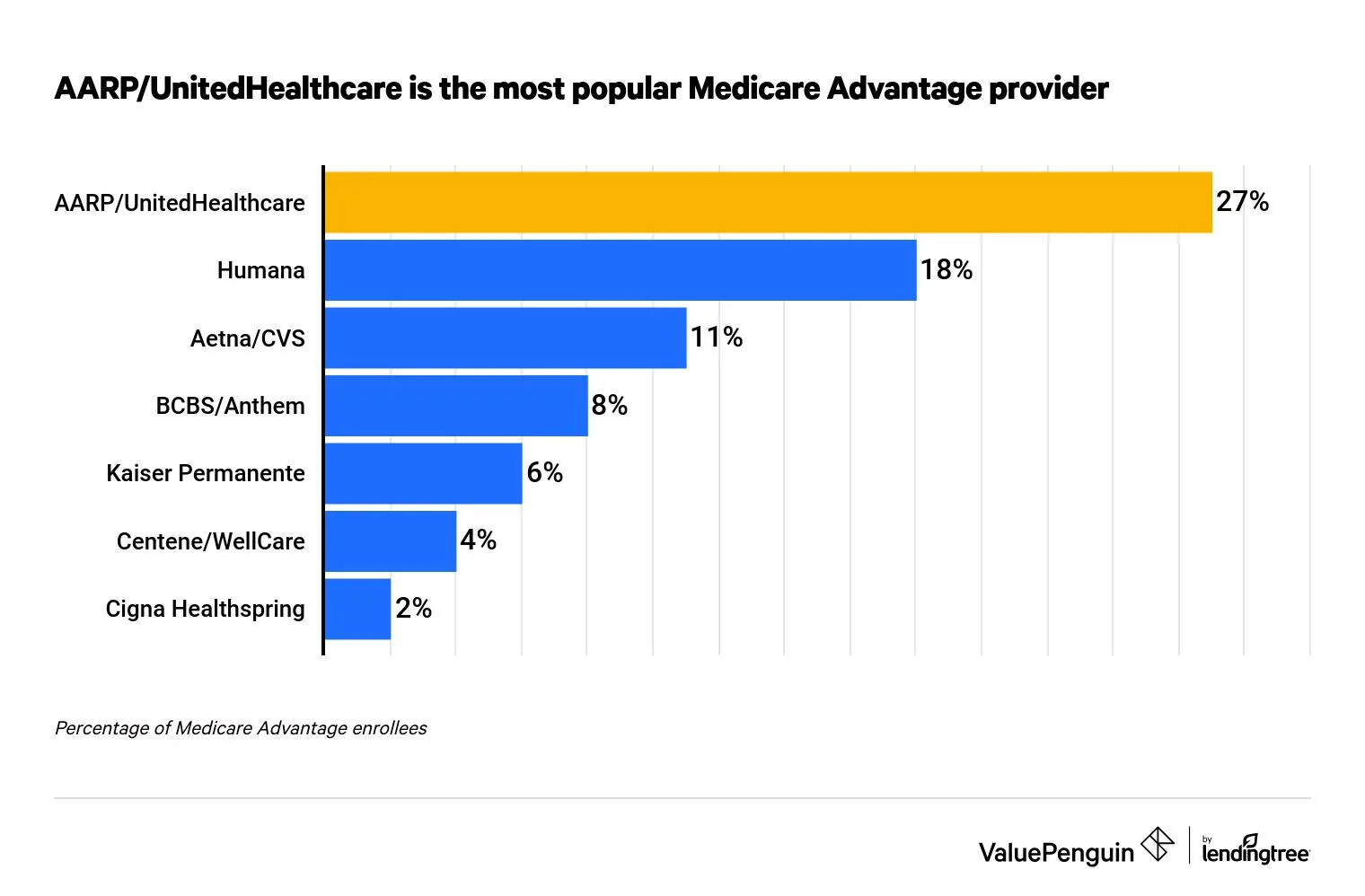

Medicare Advantage plans from AARP/UnitedHealthcare are widely available, affordable and have good overall ratings. This is a winning combination for many people because UnitedHealthcare is also the most popular provider, issuing more than a quarter of all Medicare Advantage policies.

UnitedHealthcare is a good choice for people who want coverage from a reputable national insurance company; a wide variety of plans to choose from; and lots of included perks like dental care, vision, fitness and more.

For those who want out-of-network coverage, AARP/UnitedHealthcare is an especially great choice because the cost of a local PPO plan averages $15 per month, which is 65% cheaper than the industry average.

If access to a wide range of doctors and hospitals is important to you, UnitedHealthcare has a reasonably large network of providers, but it's not as large as Blue Cross Blue Shield.

The downside of UnitedHealthcare's plans is its lackluster customer experience. Surveyed policyholders rate the plan as only 3.6 to 3.7 stars. That average performance is not as strong as some of the top-ranking companies, like Kaiser Permanente.

How Do AARP/UnitedHealthcare Medicare Advantage Plans Work?

Medicare Advantage, also called Medicare Part C, is a bundled insurance plan that's administered by a private insurance company, in this case UnitedHealthcare.

Plans cover medical care, hospitalization services and usually prescription drugs.

When comparing Medicare Advantage plans, we recommend you choose a plan based on the medical care you expect to need. If you're in good health, a low-cost plan could be the most cost effective, even if you have to pay a little more for your medical care. However, if you have chronic health issues, it may be cost effective to sign up for a more expensive plan with better benefits. For example, paying $25 more per month is worth it if the more expensive plan will save you more than $300 per year in medical care.

UnitedHealthcare Medicare Advantage Brands

Medicare Advantage plans from UnitedHealthcare are sold under four brands: AARP, Erickson Advantage, Rocky Mountain Health Plans and UnitedHealthcare.

AARP Medicare Advantage plans are the most commonly offered option — they're even more common than UnitedHealthcare-branded plans.

With an AARP Medicare Advantage plan, you do not need to be an AARP member in order to enroll in the insurance coverage. That's different from an AARP Medicare Supplement plan, where you do have to be an AARP member in order to enroll.

Availability and popularity

Including all of the brands offered, UnitedHealthcare Medicare Advantage plans are widely available throughout the country, including 48 states and the District of Columbia. Nearly as widespread are its cheap plans that cost $0 per month.

All plans: 48 states and the District of Columbia (Only Alaska and Louisiana do not have plans available.)

$0 plans: 47 states and the District of Columbia (The cheapest plan in Wyoming costs $35 per month.)

Keep in mind that Medicare Advantage plans are issued at the county level. That means plan options may change from county to county. For example, in California, UnitedHealthcare plans are only offered in about two-thirds of the state.

Cost of AARP/UnitedHealthcare Medicare Advantage

Looking only at the Medicare Advantage plans that include prescription drug coverage, this $21 per month average cost for UnitedHealthcare is cheaper than the $33 per month overall average across all companies.

However, UnitedHealthcare isn't the cheapest overall provider. Companies like Aetna and Cigna have lower overall rates and a higher percentage of $0 plans.

Medicare Advantage plans from UnitedHealthcare are also a good value. With the many included add-ons, enrollees get more for their money. And there's not a trade-off in coverage because the company's average out-of-pocket maximum matches the industry as a whole.

Medicare Advantage Cost by Plan Type

AARP/UnitedHealthcare's PPO plans are a very good deal, with average prices that are far below the industry. Not only are the PPO plans affordable, but they're also desirable because they provide more flexibility about which doctors you use because they cover both in-network and out-of-network health care.

Medical Benefits With UnitedHealthcare Medicare Advantage

For example, if you need a lab test or a specialist appointment, your doctor needs to get approval from UnitedHealthcare before you'll be covered for that service. Even though you, as the patient, are not responsible for getting this prior approval, this process can affect how quickly you can get care and add extra paperwork if the request is denied.

Coverage for prescriptions

Most AARP/UnitedHealthcare plans provide good, comprehensive prescription drug benefits, especially for generic drugs.

On average, the prescription drug deductible is $139, but many plans have no drug deductible or have generic drugs excluded from the deductible.

For generic drugs, copayments cost between $4 and $18, on average. In some areas, plans go as far as to offer free generic prescriptions.

For those who have expensive prescription drug needs that total thousands of dollars, about 97% of UnitedHealthcare's plans provide prescription benefits during the coverage gap, also called the donut hole. This can minimize costs for those who need this benefit because of high-cost medications. For others, the coverage can provide peace of mind.

What is AARP UnitedHealthcare?

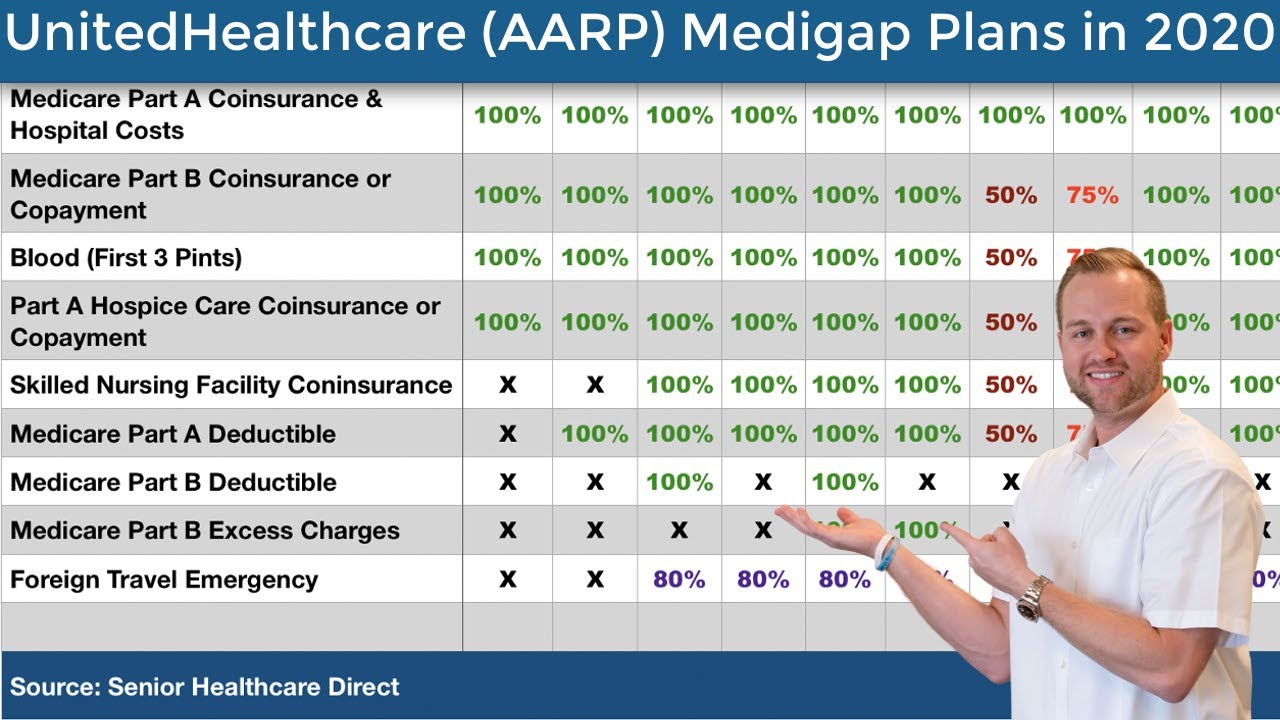

AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B. Supplement plans can help pay for some or all of the costs not covered by Original Medicare — things like coinsurance and deductibles.

What is the most popular AARP Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with 28% of all enrollment. Plans are well-rated and have affordable premiums and add-on benefits, a valuable combination that could account for AARP/UHC having the largest number of Medicare Advantage enrollees.

What is the most popular AARP Medicare Supplement plan?

By and large, Plan F is the most popular Medicare Supplement plan due to its coverage of more out-of-pocket Medicare costs than any other Medigap plan type

What is AARP used for?

At $16 a year, AARP provides access to hundreds of benefits that help you live your best life. From health and financial tools, volunteering opportunities, travel and restaurant discounts, to everything in between, if it has to do with enriching the lives of people 50-plus, this is what AARP is all about.

Is AARP the same as Medicare?

Is AARP Medicare Advantage the same as Medicare? No. AARP UnitedHealthcare Medical Advantage plans are provided by a private health insurance company

Is UnitedHealthcare a Medicare?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

How popular is the AARP?

AARP, a nonprofit, is one of the largest membership organizations in the world with 38 million members. Its membership represents a one-third of the U.S., Zeuschner noted. Every member gets a lifestyle-focused magazine six times a year.

What is a Medigap plan?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover

Is there an AARP app?

AARP Mobile Apps for iPhone and Android - AARP News App, Health & Money Tools.

Who is AARP target audience?

AARP Bulletin, with a 10-times annual frequency, spotlights news and policy-driven content that matters most to the lives of Americans over the age of 50.

Is Medigap the same as Plan B?

Part B is part of what's called Original Medicare, along with Part A. Plan B refers to Medicare supplement insurance commonly called Medigap. Part A covers hospital bills and Part B, for which a standard premium is paid, covers outpatient care, medical equipment, and other services.

What is AARP UK?

AARP in England is here to help you take on today – and every day. From sharing practical resources like job, health, and financial workshops, to holding fun activities and events, AARP is providing opportunities to connect and help build an even stronger England. We hope you'll join us!

What is the AARP elite status?

The Authorized to Offer Elite status (also known as Level 2) for AARP Medicare Supplement Plans recognizes and rewards agents who have demonstrated loyalty and a high knowledge-base with production minimum.

What is AARP senior rate?

Senior Discounts: 10-20% Off.

How much is AARP for 5 years?

With the purchase of your membership, you will receive a free second membership that you can give to any adult in your household. If you sign up for automatic renewal, you will only be charged $12 the first year. You can also select a membership term of three years for $43 or five years for $63.

How long is AARP term life?

Term life insurance. AARP members ages 50 to 74 and their spouses ages 45 to 74 can apply, and the coverage can last until the insured's 80th birthday. Although the death benefit stays level through the term, the annual price increases each time the insured person enters a new five-year age band

Does AARP have death benefits?

Death benefit: $255 for burial expenses is available to eligible spouses or dependent children. The survivor can complete the necessary form at the local Social Security office, or the funeral director may complete the application and apply the payment directly to the funeral bill.

Can 55 year old get term insurance?

Age Limit. The minimum entry age offered by most of the term plans is 18 years, whereas the maximum age at entry of the policy varies from insurer to insurer. However, in most term insurance plans, the maximum entry age ranges from 55 years-65 years.

What does the AARP stand for?

1958. The American Association of Retired Persons (now known as AARP) is founded by a retired high school principal, Ethel Percy Andrus, PhD.

What is AARP now?

It is the best of AARP membership in the palm of your hand — whenever you want it and wherever you are. Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP The Magazine.

How do I check my AARP membership?

Regardless of where you live, you can work with AARP's National Office on important issues that impact people all across the country. Support veterans, fight fraud or use your skills in other ways to help people 50-plus live their best lives.

Is there a AARP app?

AARP Mobile Apps for iPhone and Android - AARP News App, Health & Money Tools.

What is similar to AARP?

AMAC is a membership organization for people age 50 and over. The group calls itself "the conservative alternative to the AARP." It is one of several organizations to position itself as conservative rivals to the AARP; others include the American Seniors Association and 60 Plus Association.

Some Ponts :

1. Chase Ultimate Rewards: This program allows you to earn points on eligible purchases made with Chase credit cards. Points can be redeemed for travel, cash back, gift cards, and more.

2. American Express Membership Rewards: American Express cardholders can earn points on eligible purchases, which can be redeemed for travel, merchandise, gift cards, and other rewards.

3. Citi ThankYou Rewards: This program allows you to earn points on qualifying purchases made with Citi credit cards. Points can be redeemed for travel, merchandise, gift cards, and cash back.

4. Capital One Venture Rewards: Capital One credit cardholders can earn miles on purchases, which can be redeemed for travel expenses or transferred to partner loyalty programs.

5. Discover it Cash Back: Discover credit cardholders can earn cash back on purchases, and Discover matches all the cash back earned during the first year.

Read More: