Medigap (Medicare Supplement Health Insurance)

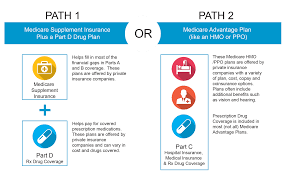

Medicare doesn’t cover all of your health care expenses when you turn 65. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies. For the 20% not covered by Medicare, you have the option to purchase Medicare Supplement (Medigap) insurance from a private insurance company.

To determine the best Medicare Supplement providers, the Forbes Health editorial team analyzed data on U.S. insurance companies that offer nationwide plans by the number of states in which they provide coverage, the number of types of plans they offer, how they ranked in terms of their financial health by agencies like A.M. Best and more. Read on to see which providers made our list.

Despite the coverage offered by Medicare Parts A and B, gaps in coverage persist, necessitating additional insurance to safeguard against unexpected medical expenses.

The Role of Medicare Supplemental Insurance:

Medicare Supplemental Insurance, or Medigap, is a private insurance policy designed explicitly to fill the voids in traditional Medicare coverage. These policies are regulated and standardized by the federal government, simplifying the process of selecting suitable coverage. Here are the fundamental aspects of Medigap:

Coverage for Out-of-Pocket Costs: Medigap plans typically cover deductibles, copayments, and coinsurance associated with Medicare Part A and Part B. Consequently, beneficiaries can significantly reduce their out-of-pocket expenses linked to Medicare-covered services.

Freedom to Choose Providers: Unlike certain Medicare Advantage plans, Medigap policies generally do not confine beneficiaries to specific networks of healthcare providers. Seniors can freely select their doctors and hospitals, provided they accept Medicare patients.

Predictable Costs: Medigap offers beneficiaries more predictability in healthcare costs. They have a clear understanding of their monthly premiums and are shielded from unforeseen medical bills.

Coverage for Travel: Certain Medigap plans extend coverage to healthcare services received outside of the United States. This is especially valuable for seniors who enjoy traveling.

Guaranteed Renewable: Medigap policies are guaranteed renewable, provided beneficiaries pay their premiums. Insurance companies cannot terminate policies as long as financial obligations are met.

Choosing the Right Medigap Plan:

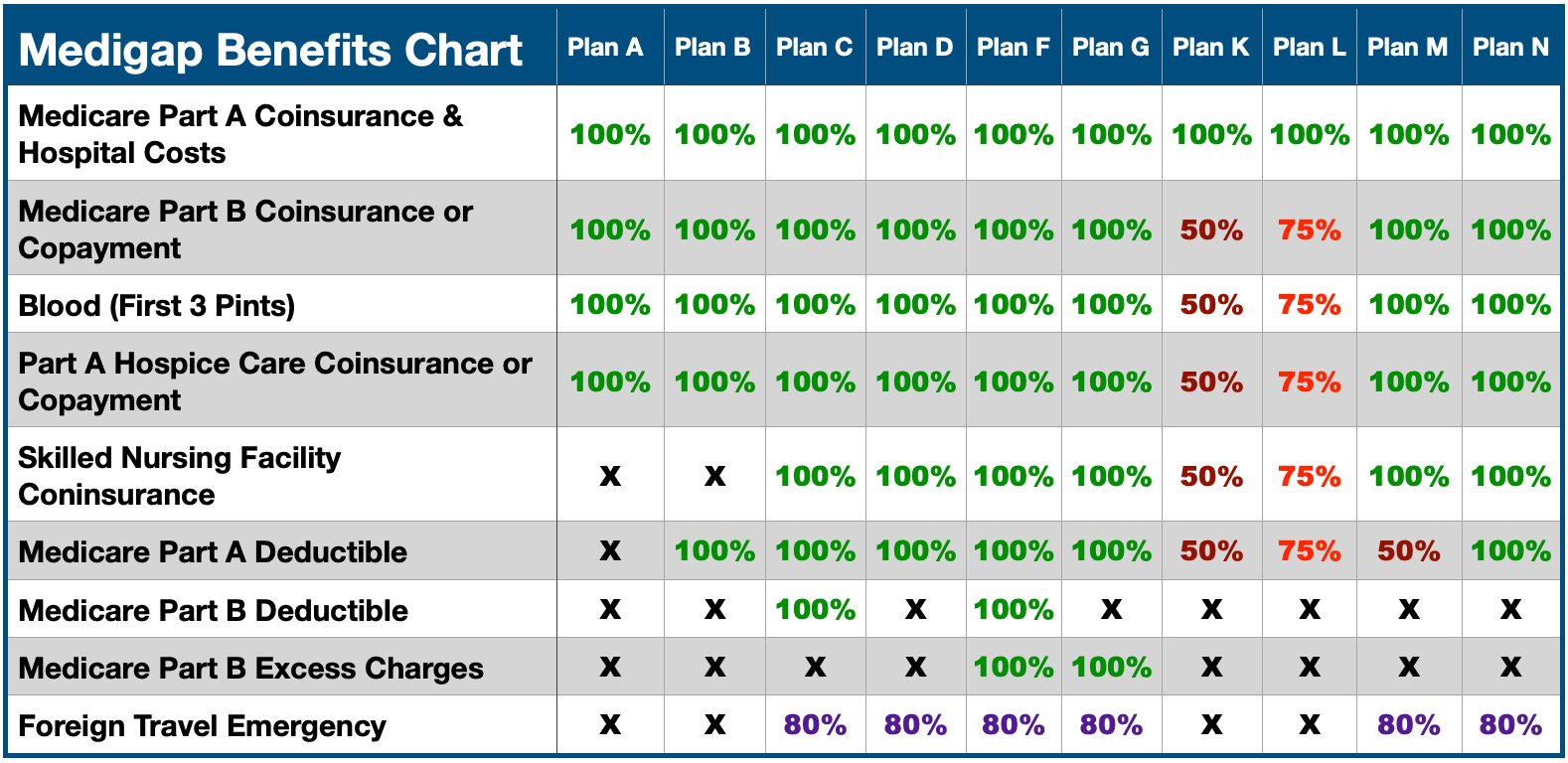

Medigap plans are denoted by letters from A to N, each offering a distinct combination of coverage. It is essential to choose a plan that aligns with your specific healthcare requirements and budget. Factors to consider include your health status, preferred healthcare providers, and your financial capacity.

Exploring Medigap Plan Options:

Medigap plans come in a variety of options, each designated by a letter of the alphabet. Although standardized by the federal government, these plans offer different levels of coverage to accommodate varying healthcare needs and financial circumstances. Here's a concise overview of some common Medigap plans:

Plan A: This represents the most basic Medigap plan, covering Medicare Part A and Part B coinsurance, as well as hospital costs for an additional 365 days after Medicare benefits are exhausted.

Plan F: Previously regarded as the most comprehensive Medigap plan, Plan F covered all deductibles, copayments, and coinsurance associated with Medicare. However, it is no longer available for new Medicare enrollees since January 1, 2020.

Plan G: Similar to Plan F, Plan G provides robust coverage but does not include the Medicare Part B deductible. It has become a popular choice among beneficiaries due to its comprehensive coverage and generally lower premiums compared to Plan F.

Plan N: Plan N offers comprehensive coverage while requiring beneficiaries to pay modest copayments for certain doctor's office visits and emergency room visits. It often has lower premiums than Plans F and G.

High Deductible Plan F: This plan operates similarly to regular Plan F but features a higher deductible. Once the deductible is met, it covers the same benefits as Plan F. It is often chosen by those seeking lower monthly premiums and who are willing to pay a higher deductible when necessary.

Plan K and Plan L: These plans introduce cost-sharing elements, where beneficiaries cover a portion of the costs of covered services. Plan K covers 50% of most Medicare-covered services, while Plan L covers 75%. These plans can have lower premiums but require beneficiaries to share a higher portion of their healthcare expenses.

Plan M: Plan M covers half of the Medicare Part A deductible and excludes the Part B deductible. It offers a middle-ground option for individuals seeking some coverage without the higher premiums associated with Plans F or G.

The Importance of Timely Enrollment: Enrolling in a Medigap plan during your open enrollment period is crucial. This period typically begins when you turn 65 and enroll in Medicare Part B. During open enrollment, insurance companies are prohibited from denying coverage based on your health status or charging higher premiums due to pre-existing conditions. Missing this enrollment window could limit your choices and potentially lead to higher premiums.

Consider Future Healthcare Needs: When evaluating Medigap plans, it's essential to consider your future healthcare needs. While you may be healthy at the time of enrollment, health circumstances can change. Opting for a plan with coverage that accommodates potential future healthcare needs can provide long-term peace of mind.

Freedom to Choose Providers: Medigap plans generally do not restrict beneficiaries to specific networks of doctors and hospitals. This means you can freely select your healthcare providers, provided they accept Medicare patients. You do not require referrals to see specialists.

Predictable Costs: With a Medicare Supplement Plan, your healthcare costs become more predictable. You are aware of your monthly premium, and you don't need to worry about unexpected medical bills. This predictability can be especially important for retirees on fixed budgets.

Coverage for Medicare Part B Excess Charges: Some Medigap plans offer coverage for excess charges under Medicare Part B. These charges occur when doctors or providers charge more than the Medicare-approved amount. Medigap can cover some or all of these excess charges, ensuring you don't have to pay the difference.

Coverage for Foreign Travel: If you're a traveler, some Medigap plans extend coverage to emergency medical care received outside of the United States. This can provide peace of mind when exploring other countries.

Guaranteed Renewability: Medigap plans are guaranteed renewable as long as you pay your premiums. Insurance companies cannot cancel your policy, regardless of changes in your health or medical conditions.

Simplicity: Medigap plans are standardized by the federal government, meaning that Plan A from one insurer offers the same benefits as Plan A from another insurer. This makes it easier for beneficiaries to compare plans and choose the one that best suits their needs.

Enroll at Any Time: While it's advisable to enroll during your open enrollment period, which begins when you turn 65 and enroll in Medicare Part B, you can apply for a Medigap plan at any time. However, if you apply outside of your open enrollment period, insurers may consider your health status and could charge higher premiums.

Peace of Mind: Perhaps the most significant benefit of Med

Exploring Medigap Plan Options:

Medigap plans offer a variety of options, each identified by a letter of the alphabet. While these plans are standardized by the federal government, they provide different levels of coverage to accommodate various healthcare needs and financial situations. Here's a concise overview of some common Medigap plans:

Plan A: This is the most basic Medigap plan, covering Medicare Part A and Part B coinsurance, along with hospital costs for up to an additional 365 days after Medicare benefits are exhausted.

Plan F: Previously known as the most comprehensive Medigap plan, Plan F covered all Medicare deductibles, copayments, and coinsurance. However, it is no longer available for new Medicare enrollees as of January 1, 2020.

Plan G: Plan G is similar to Plan F but does not include coverage for the Medicare Part B deductible. It has become a popular choice among beneficiaries because it provides substantial coverage while generally offering lower premiums than Plan F.

Plan N: Plan N offers comprehensive coverage but requires beneficiaries to pay small copayments for some doctor's office visits and emergency room visits. It may have lower premiums than Plans F and G.

High Deductible Plan F: This plan functions similarly to regular Plan F but has a higher deductible. After meeting the deductible, it covers the same benefits as Plan F. It is often chosen by individuals seeking lower monthly premiums and are willing to pay a higher deductible when necessary.

Plan K and Plan L: These plans introduce cost-sharing features, where beneficiaries are responsible for a portion of the costs of covered services. Plan K covers 50% of most Medicare-covered services, while Plan L covers 75%. These plans may have lower premiums but require beneficiaries to share a higher portion of their healthcare expenses.

Plan M: Plan M covers half of the Medicare Part A deductible and does not include coverage for the Part B deductible. It offers a middle-ground option for those seeking some coverage without the higher premiums of Plans F or G.

The Importance of Timely Enrollment:

Enrolling in a Medigap plan during your open enrollment period is crucial. This period typically begins when you turn 65 and enroll in Medicare Part B. During open enrollment, insurance companies cannot deny you coverage based on your health status or charge you higher premiums due to pre-existing conditions. Missing this enrollment window may limit your choices and potentially result in higher premiums.

Consider Future Healthcare Needs:

As you explore Medigap plans, it's essential to consider your future healthcare needs. While you may be healthy when you first enroll, health circumstances can change. Opting for a plan with coverage that accommodates potential future healthcare needs can provide long-term peace of mind.

The Benefits of Medicare Supplement Plans: Enhancing Your Healthcare Coverage:

Medicare, the federal health insurance program for seniors aged 65 and older, provides vital healthcare coverage. However, it does not cover all expenses, leaving beneficiaries exposed to potential out-of-pocket costs. This is where Medicare Supplement Plans, also known as Medigap, play a significant role. These supplementary insurance plans are specifically designed to fill the gaps in Medicare coverage and offer a range of benefits:

Comprehensive Coverage: Medicare Supplement Plans provide comprehensive coverage for a wide range of healthcare expenses. This can include deductibles, coinsurance, and copayments associated with Medicare Part A (hospital insurance) and Part B (medical insurance).

Freedom to Choose Providers: Medigap plans generally do not restrict beneficiaries to specific networks of doctors and hospitals. This means you can freely select your healthcare providers, provided they accept Medicare patients. You do not require referrals to see specialists.

Predictable Costs: With a Medicare Supplement Plan, your healthcare costs become more predictable. You are aware of your monthly premium, and you don't need to worry about unexpected medical bills. This predictability can be especially important for retirees on fixed budgets.

Coverage for Medicare Part B Excess Charges: Some Medigap plans offer coverage for excess charges under Medicare Part B. These charges occur when doctors or providers charge more than the Medicare-approved amount. Medigap can cover some or all of these excess charges, ensuring you don't have to pay the difference.

Coverage for Foreign Travel: If you're a traveler, some Medigap plans extend coverage to emergency medical care received outside of the United States. This can provide peace of mind when exploring other countries.

The Role of IAC Medicare Supplement Insurance:

IAC's Medicare Supplement Insurance, also known as Medigap, is a private insurance policy designed to complement traditional Medicare (Part A and Part B). These policies are standardized by the federal government, simplifying the process of understanding and comparing coverage options. IAC offers a variety of Medigap plans to help its members bridge the gaps in their healthcare coverage.

Key Benefits of IAC Medicare Supplement Insurance:

Comprehensive Coverage: IAC Medigap plans cover various out-of-pocket expenses, including deductibles, copayments, and coinsurance associated with Medicare Part A and Part B. This ensures that beneficiaries have financial protection and do not face unexpected medical costs.

Freedom to Choose Providers: IAC's Medigap plans generally do not restrict members to a specific network of doctors and hospitals. Beneficiaries have the flexibility to choose their healthcare providers, provided they accept Medicare patients.

Predictable Costs: With an IAC Medigap plan, members have more predictable healthcare costs. They know their monthly premium and can budget for their healthcare expenses more effectively.

Coverage for Medicare Part B Excess Charges: Some IAC Medigap plans offer coverage for Medicare Part B excess charges. These charges occur when healthcare providers charge more than the Medicare-approved amount. Medigap can cover some or all of these excess charges, saving members money.

Foreign Travel Coverage: For individuals who love to travel, certain IAC Medigap plans provide coverage for emergency medical care received outside of the United States, offering peace of mind while exploring other countries.

Guaranteed Renewability: IAC's Medigap plans are guaranteed renewable, as long as members pay their premiums on time. This means that IAC cannot cancel the policy due to changes in the member's health or medical conditions.

Member-Centric Service: IAC is known for its dedication to its members and their unique needs. They offer personalized customer service and support to ensure members understand their coverage and can make informed decisions.

Enrolling in IAC Medicare Supplement Insurance:

Enrolling in IAC Medigap plans typically takes place during your open enrollment period, which begins when you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies, including IAC, cannot deny you coverage or charge higher premiums based on your health status. However, if you apply for Medigap outside of your open enrollment period, IAC may consider your health status and could charge higher premiums.

Medicare Supplement Plans in CaliforniA: Bridging Healthcare Coverage Gaps: In California, as in the rest of the United States, Medicare beneficiaries often seek ways to enhance their healthcare coverage and minimize out-of-pocket expenses. Here, we'll explore various aspects of Medicare Supplement Plans, commonly known as Medigap, and provide insights into related healthcare topics:

Understanding Medicare Supplement Plans:

H5216 and Medigap: H5216 is a specific Medicare Advantage plan available in some regions. Medigap, on the other hand, is private insurance that works alongside Original Medicare (Part A and Part B) to cover additional healthcare costs.

H5216 199 and H5216 140: These numbers likely refer to specific variations or benefits offered by the H5216 Medicare Advantage plan. It's essential to review plan details to understand their coverage.

Medigap Insurance Quotes: Obtaining quotes for Medigap insurance is a critical step in finding the right plan. Quotes can vary by plan type, location, and insurance provider.

Medicare Supplemental Insurance Quotes: These quotes help beneficiaries compare the costs and benefits of different Medigap plans to make informed decisions about their healthcare coverage.

Medicare Supplement Near Me: Locating Medicare Supplemental Insurance providers nearby is essential for beneficiaries who prefer local service and support.

Dental and Vision Coverage:

Medicare Supplemental Dental and Vision Insurance: Medigap plans do not typically include dental or vision coverage. Beneficiaries may need to explore standalone dental and vision insurance plans for comprehensive coverage.

Enrollment and Plan Selection:

Medicare Supplement Plan Enrollment: Enrolling in a Medigap plan should align with your healthcare needs and budget. Consider your open enrollment period, which offers certain protections regarding pre-existing conditions. Other Healthcare Topics:

Cigna Supplemental Health: Cigna is one of the many insurance providers that offer Medigap plans and other supplemental health insurance options.

Medicare Part B Supplemental Insurance: Medigap plans often cover Medicare Part B expenses, such as copayments and coinsurance, providing financial relief.

Medicare Part D and Medicare Part A: These are parts of the Medicare program, with Part D focusing on prescription drug coverage, and Part A covering hospital and inpatient care.

Medicaregov: Medicare's official website provides essential information about the program, enrollment, and plan options.

PPO and HMO Plans: These are common types of Medicare Advantage plans, offering different network structures and coverage options.

Medicare Age and Enrollment: Most individuals become eligible for Medicare at age 65, but enrollment can vary depending on individual circumstances.

My Medicare: An online portal for Medicare beneficiaries to access their benefits, claims, and other program-related information.

Advantage Dental: Some Medicare Advantage plans offer dental coverage as part of their benefits.

Apply for Medicare: Understanding the Medicare application process is essential for those approaching eligibility.

Medigap: Also known as Medicare Supplement Plans, Medigap policies help fill gaps in Medicare coverage.

Medicare Open Enrollment: This annual period allows beneficiaries to make changes to their Medicare Advantage or Part D prescription drug plans.

Medicare Enrollment: Enrolling in Medicare involves specific timelines and eligibility criteria.

Consumer Reports: Evaluating the Best Medicare Supplemental Insurance

Consumer Reports Best Medicare Supplemental Insurance:

Consumer Reports Best Medicare Supplemental Insurance: Consumer Reports provides detailed assessments of Medicare Supplemental Insurance plans. These evaluations consider factors such as coverage, cost, customer satisfaction, and financial stability of insurance companies. By referring to their findings, beneficiaries can identify the top-rated Medigap plans that align with their specific healthcare needs.

Worst Medicare Supplement Companies: While Consumer Reports often highlights the best options, they also draw attention to underperforming Medicare Supplement providers. These reports serve as a cautionary guide, helping beneficiaries avoid companies with subpar customer service, coverage, or financial stability.

Purpose of Medigap Coverage:

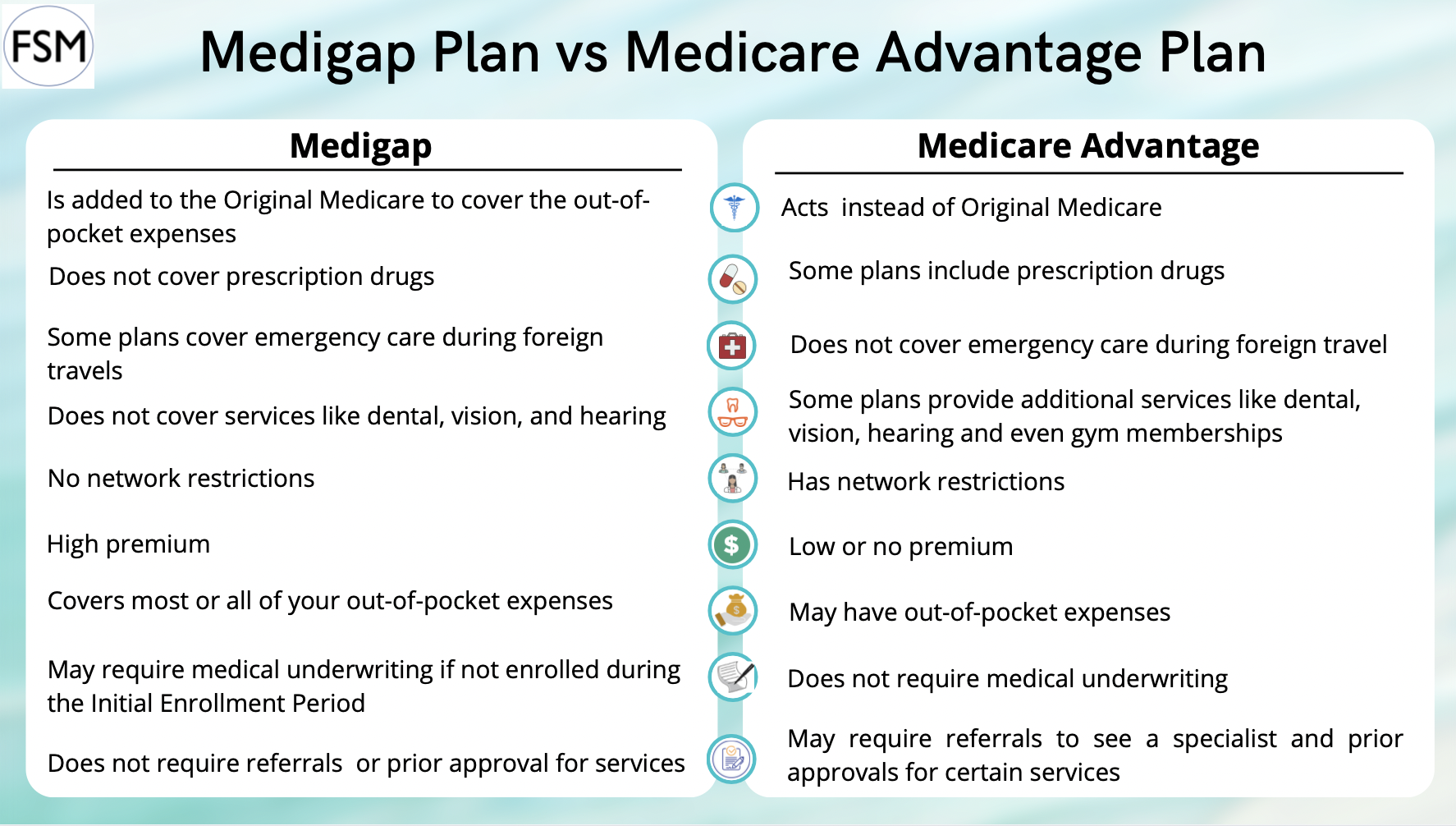

Purpose of Medigap Coverage: Medigap coverage is designed to fill gaps in Original Medicare, including Part A and Part B. It assists beneficiaries in paying for certain out-of-pocket costs such as deductibles, copayments, and coinsurance. The specific expenses covered vary by Medigap plan type, allowing beneficiaries to choose the one that best suits their needs. Medicare Supplement vs. Medicare Advantage:

Medicare Supplement vs. Medicare Advantage: Understanding the differences between

FAQs

Q: Do I Need a Medicare Supplement Plan if I Have Original Medicare?

A: While not required, Medicare Supplement Plans can be valuable for those who want to minimize out-of-pocket costs and have more predictable healthcare expenses.

Q: What Does Medigap Cover?

A: Medigap plans cover various healthcare costs, including Medicare deductibles, copayments, and coinsurance. Some plans also offer coverage for excess charges, foreign travel emergencies, and more.

Q: Can I Use My Medigap Plan with Medicare Advantage?

A: No, you cannot use a Medigap plan with Medicare Advantage. These two types of coverage cannot be used together. You must choose one or the other.

Q: Can I Change My Medigap Plan After Enrollment?

A: Yes, you can switch Medigap plans at any time, but insurers may consider your health status and could charge higher premiums if you apply outside of your open enrollment or guaranteed issue rights period.

Q: Do Medigap Plans Cover Prescription Drugs?

A: No, Medigap plans do not provide prescription drug coverage. To get this coverage, you need to enroll in a standalone Medicare Part D prescription drug plan.

Q: What is Medicare supplemental insurance?

A: Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare.

Q: Why would I need a Medicare Supplement plan?

A: Though Original Medicare provides some health coverage, it does not pay for everything. A Medicare Supplement plan (Medigap) helps cover the gaps in coverage, reducing your out-of-pocket expenses.

Q: Is Medicare Supplement worth it?

A: If you have Original Medicare, a Medicare Supplement plan may help you cover the costs of your healthcare, saving you money. While it comes with premiums, it can provide financial security by covering expenses that Medicare alone doesn't.

Q: What supplement is best for Medicare?

A: Plan F, Plan G, and Plan N are among the most popular types of Medicare Supplement plans. Medicare Supplement Plan F is the most comprehensive, offering coverage for nearly all Medicare-covered expenses after Original Medicare pays its portion. However, Plan availability may vary by location and insurance company, so it's essential to compare options to find the one that suits your needs best.

Q: What is Medicare supplementary plan?

A: A Medicare Supplement insurance plan , also known as Medigap, is healthcare insurance you can buy that may help pay for the out-of-pocket costs Original Medicare doesn't cover.

Q: Why would I need a Medicare Supplement plan?

A: A Medigap plan (also called a Medicare Supplement), sold by private companies, can help pay some of the health care costs Original Medicare doesn't cover, like copayments, coinsurance and deductibles.

Q: Is Medicare Supplement worth it?

A: If you have Original Medicare, a Medicare Supplement plan may help you cover the costs of your healthcare, therefore saving you money. This is because, while offering great benefits, Medicare Part A and Part B will not cover all of your healthcare costs, leaving you with expenses to cover.

Q: What is the Plan G for Medicare?

A:Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. Premium costs vary widely, depending on where you live. In many states, costs also vary based on your gender and whether you smoke or vape. If you qualify for Original Medicare, you may be able to enroll in Plan G.